941 Worksheet 1 Draft. Now the irs has issued the draft form 941 instructions that include new worksheet 1 for figuring the tax credits for the cares act employee retention credit and or the ffcra paid leave credits. Form 941 has been revised to allow employers that defer the withholding and payment of the employee share of social security tax on wages paid on or after september 1 2020 to include the deferral on line 13b.

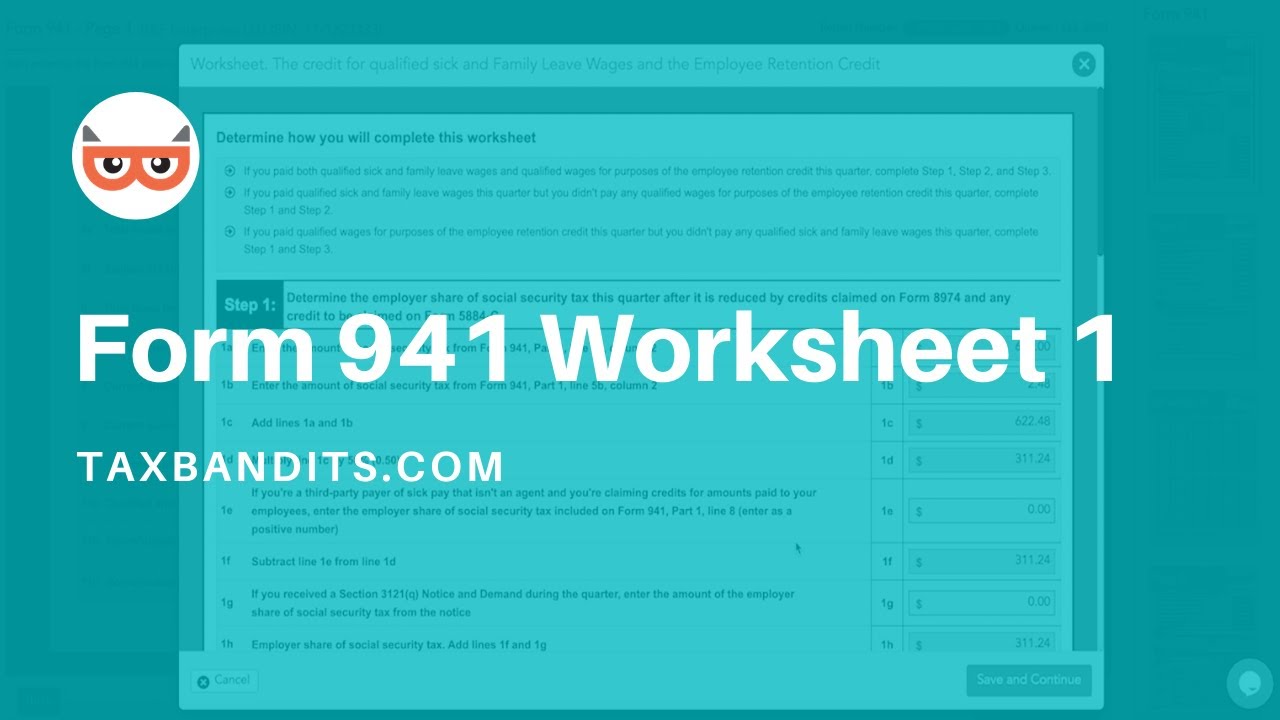

It is necessary to complete worksheet 1 before preparing the form 941. Subtract the amount with any adjustments on line 8 of form 941 if you re a third party sick payer the amount from form 941 line 11a credit from form 8974 and the amount to be claimed on form 5884 c line 11 for the applicable quarter. All you need to know about form 941 worksheet 1 2020.

Employers will now report on line 13b the total.

Form 941 has been revised to allow employers that defer the withholding and payment of the employee share of social security tax on wages paid on or after september 1 2020 to include the deferral on line 13b. To do so add form 941 part 1 line 5a column 2 and form 941 part 1 line 5b column 2. Updated on january 20 2021 10 30 am by admin taxbandits. Employers who file form 941 employer s quarterly federal tax return must file the revised form with covid 19 changes from quarter 2.